2022 Capital Gains and The Corresponding Tax Rates

Article by - Fabiana Suskin, Tax Associate

What is a capital gain? A capital gain happens when you sell or exchange a capital asset for a higher price than its basis. The “basis” is what you paid for the asset, plus commissions and the cost of improvements, minus depreciation. It’s considered to be realized when the asset is sold. Once sold, proceeds are considered taxable income.

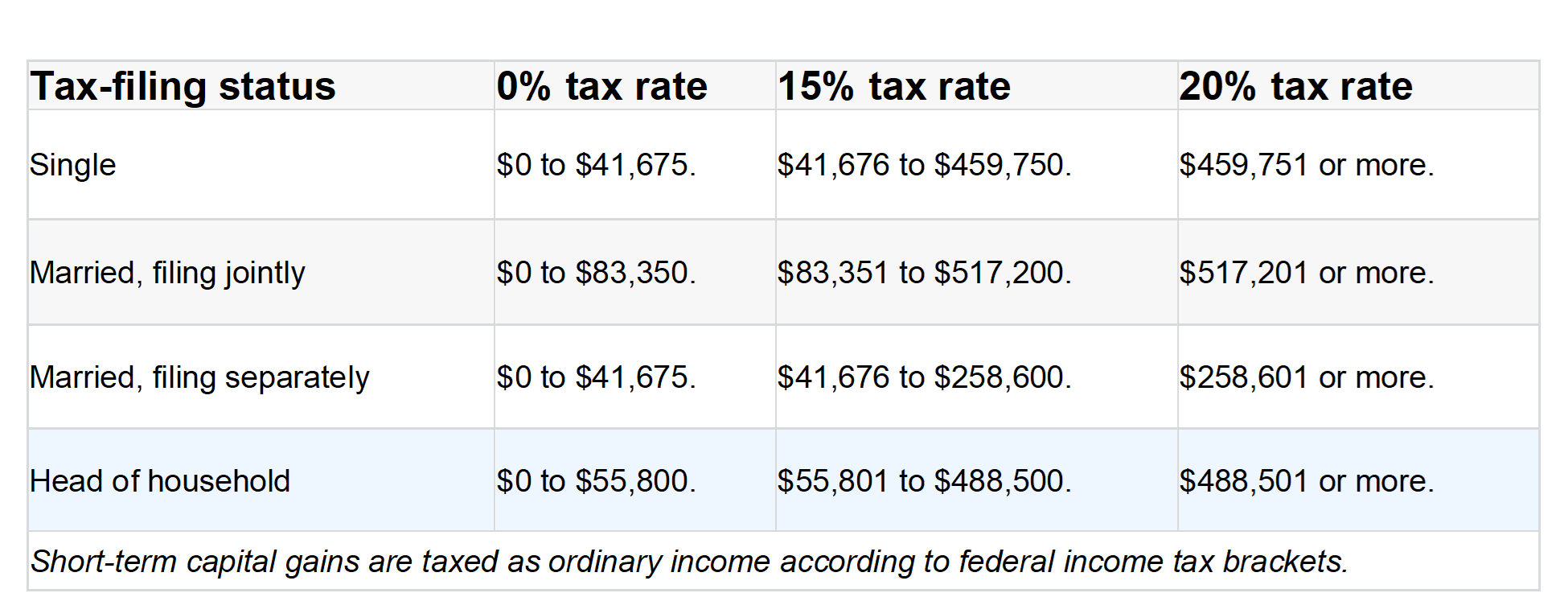

Now having some insight on what capital gains are, many tend to ask themselves how much income they can bring in without having to pay income tax on those gains. The length of time an asset is owned plays a major role in determining the amount owed. Long-term capital gains taxes are paid when you’ve held an asset for more than one year, and short-term capital gains apply to profits from an asset you’ve held for one year or less. Note that by holding on to an asset longer, you can then qualify for the long-term capital gains tax rate, which is significantly lower than the short-term capital gains rate for most assets.