Adoption Credit

Article by Fabiana Suskin, Tax Associate

The Federal Adoption Credit is a non-refundable tax credit that helps families offset the costs of qualifying adoption expenses. For adoptions finalized in 2022, there is a tax credit of up to $14,890 per child, for children under the age of 18 with a modified adjusted gross income (MAGI) phaseout threshold of $223,410 - $263,410. Taxpayers are only able to use the credit if they have federal income tax liability. The adoption credit applies one time for each adopted child and should be claimed when filing 2022 taxes.

According to the Internal Revenue Service, qualified adoption expenses can include items such as:

Reasonable and necessary adoption fees

Court costs and attorney fees

Traveling expenses related to adoption

Other expenses that are directly related to and for the principal purpose of the legal adoption of an eligible child

When claiming the adoption tax credit, you will want to have the following documents ready:

The final adoption decree

A placement agreement from an authorized agency

Court documents

A state’s determination for special needs children (if applicable)

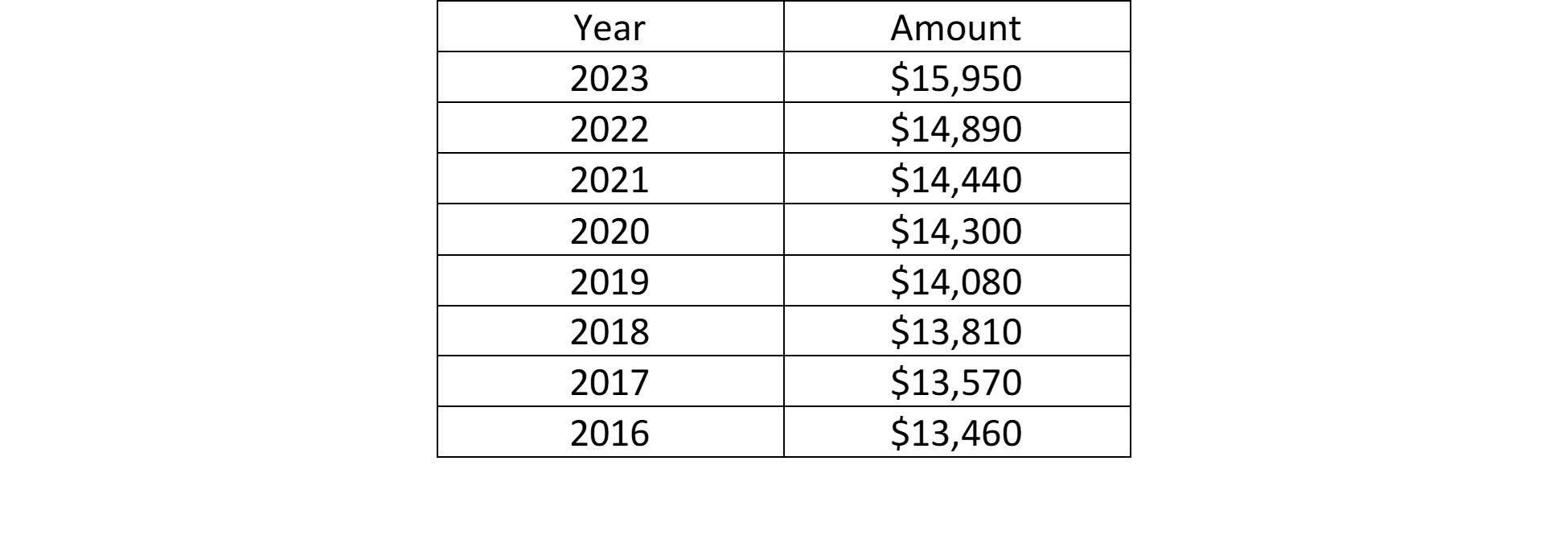

Many ask why the adoption tax credit amount changes from year to year. This is typically due to inflation. The eligibility restrictions upon the taxpayers’ MAGI are also adjusted yearly for inflation. There has been an increase each year in the maximum amount a family can receive. The maximum adoption tax credit per year is shown below.

Key Information:

Future: 2023 Adoption Tax Credit – If you adopt a child in 2023, the credit maximum amount will be $15,950 with an AGI phaseout threshold of $239,230 to $279,230.

Present: 2022 Adoption Tax Credit – If you adopt a child in 2022, the credit maximum amount will be $14,890 with an AGI phaseout threshold of $223,410 to $263,410.

Past: 2021 Adoption Tax Credit – for the past tax year 2021, the maximum adoption credit was $14,440 per child with a phaseout range of $216,660 – $256,660.